I wrote a detailed statistical follow-up showing how a trading strategy based upon securing a few very large winners can be an extremely profitable model to follow. Today I am going to write a concluding piece to this series, and provide a refined statistical analysis of comparative entry techniques. Last week’s piece did include a statistical error, but as often happens with errors if they are discovered in time, it led me to some interesting conclusions which I am going to share with you today.

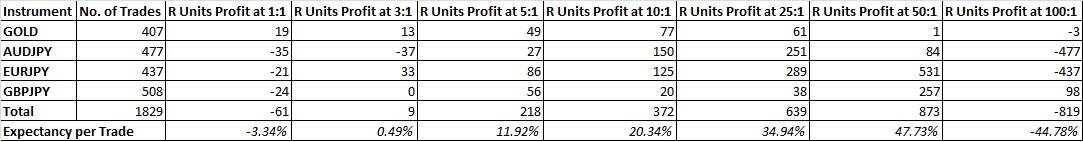

First of all, a correction of the error in last week’s article has to be made. Statistics were shown that were described as the result of buying engulfing bars that make a 4 bar low and selling engulfing bars that make a 5 bar high, as reproduced below:

In fact, the statistics shown above were produced by different criteria for entry, which were buying engulfing bars that make a 4 bar high and selling engulfing bars that make a 4 bar low: quite an essential difference!

This begs an obvious question: which entry strategy is superior? Buying the reversals at extremes, or as continuations within some kind of trend? This is what I will examine below, but to try to improve both sets of results I have added an additional filter, which is that the range of the trigger bar must not be larger than a defined maximum amount. It would have been more scientifically rigorous to use this as some measure of averaged range, but using a numerical value does about as well for our purpose. The maximum values used were as follows:

AUD/JPY: 40 pips

EUR/JPY: 60 pips

GBP/JPY: 50 pips

GOLD: $6

Additionally, bars under 10 pips or $1 were excluded from the samples.

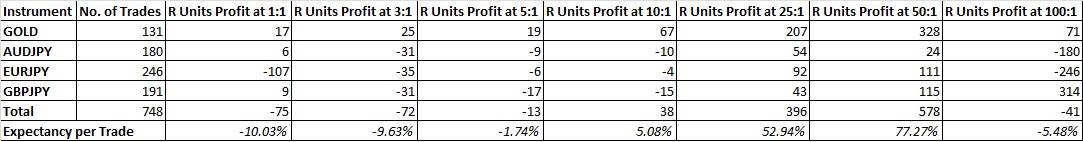

First of all, let’s see the results that were obtained by taking the extreme reversals, i.e. buying after a 4 bar low and selling after a 4 bar high as described above:

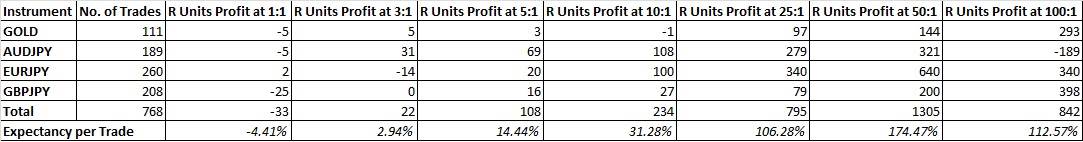

Now let’s see how the “in-trend” variation performed, i.e. buying after a 4 bar high and selling after a 4 bar low:

We can see that overall, at each different profit target, the expectancy per trade given by the “in-trend” variation is superior to the “extreme reversal” variation, and markedly so. The only real exception is Gold, and also GBPJPY to a slight extent.

Conclusion

Why should it be that the extreme reversal strategy is inferior? The simple answer is that although it gets you into the great trades early at excellent prices; it gets you into too many counter-trend trades. You get the winners, but you also get too many losers. By trading with the trend on the H4 chart as an alternative, your trades will be skewed in the direction of the prevailing trends, keeping you out of all those unnecessary losers.

What explains Gold’s contrary behaviour? Well, what has been very noticeable about Gold over the past few years is the violence and speed with which it reverses and follows through, as well as the fact that it has more or less both doubled and then halved in price in the space of just a few years, which is unlikely to repeated in the near future.

One important thing remains and that is to perform an “out of sample” test along similar lines over a similar time period previous to 2011. I have not completed that yet, but when I do, there will be an update to this series.

No comments:

Post a Comment